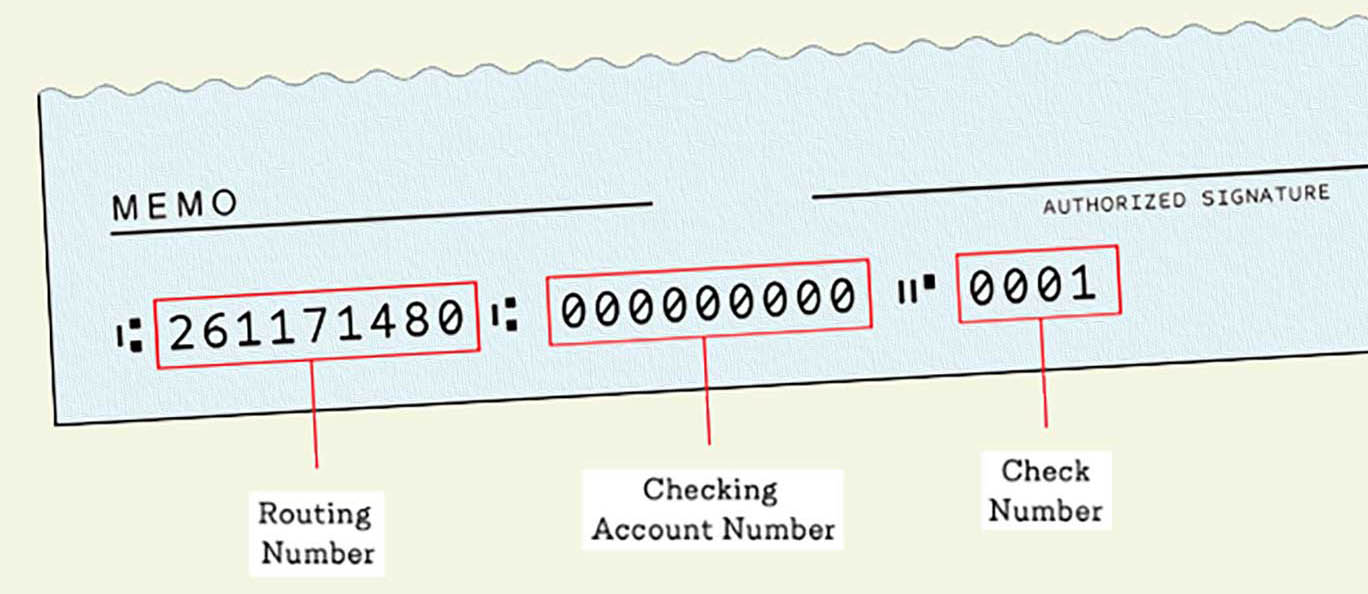

ET on Wed., March 17, exactly as instructed by the IRS.” “Regardless of when payment files were sent and received, settlement of the funds for the payments will occur at 8:30 a.m. The IRS chose the date of March 17, which is the date on which the IRS intends for settlement to occur,” Nacha said. “It is up to the sender - in this case the IRS - to decide when it wants the money to be made available. “‘It is up to the sender-in this case the IRS-to decide when it wants the money to be made available.’ ” - The National Automated Clearing House Association That choice has been around since 2016, it noted. There’s also a same-day option that wraps the money and the direct deposit information together. Nacha said its rules let the information on direct deposits use an “effective date” that’s either one or two banking days in the future. There’s the information on the amount that gets beamed from payer to recipient, and then there’s the actual money transmission. The National Automated Clearing House Association or “Nacha” oversees the ACH Network and, on Monday, it explained the process with stimulus checks. ACH stands for “Automated Clearing House” and the ACH Network is a massive payment system platform that beamed nearly 27 billion payments last year from all sorts of payers to recipients totalling approximately $62 trillion.

The IRS is sending out the economic impact payments via the ACH Network.

Banks collected approximately $11.7 billion in overdraft fees in 2019, according to study last year from the Center for Responsible Lending. “That time delay costs American living on the edge millions, billions in fees,” he added. Speed counts and any sluggishness is a particular problem now, Klein said. “Banks collected approximately $11.7 billion in overdraft fees in 2019. It takes Uncle Sam six days to get digital money in your bank account,” he said, specifically faulting the Federal Reserve for its oversight of the figurative pipes that pour out government money. The pace of that transit is the problem for Klein, who was the Treasury Department’s deputy assistant secretary for economic policy from 2009 to 2012.Ĭan get anything in the world physically to your door in under 48 hours.

The money is in transit,” said Aaron Klein, senior fellow at the liberal-leaning Brookings Institution. “Right now, the banks know the information was transmitted. “We know the importance of the stimulus funds to our customers, and Wells Fargo is making the stimulus funds available immediately when they are made available to us,” a Wells FargoĪ two-step process of sending out the checks highlights long-term failures by the federal government, at least one critic argues. Because Chase does not actually have the money, it’s not earning interest, the bank confirmed. “When we receive the money from the IRS on Wednesday, we’ll immediately deposit it in our customers’ accounts,” a Chase Bank Wed., March 17 is the official payment date, the IRS said. The banks, for their part, say they will make the cash available as soon as they get it. That announcement sparked intense ire on social media, with furious customers accusing banks such as Wells Fargo and Chase of “holding our money hostage.”

0 kommentar(er)

0 kommentar(er)